Dreaming of reaching the summit with your tech startup in India? Let angel investors guide you to the peak!

Tech startups have become progressively popular in India, especially in recent years. Innovative entrepreneurs often lead these startups with a vision to disrupt the existing market and introduce new and innovative products or services. However, starting a tech company in India requires a lot of resources and capital, which may necessitate extra diligence and perseverance from aspiring entrepreneurs. This is where angel investors come in. Angel investors are individuals who deliver funding and support to startups, often in exchange for equity in the company. This article will discuss how angel investors can help fund tech startups in India, with examples and a conclusion.

Capitalizing on India’s tech potential: Angel Investors’ strategic plan:

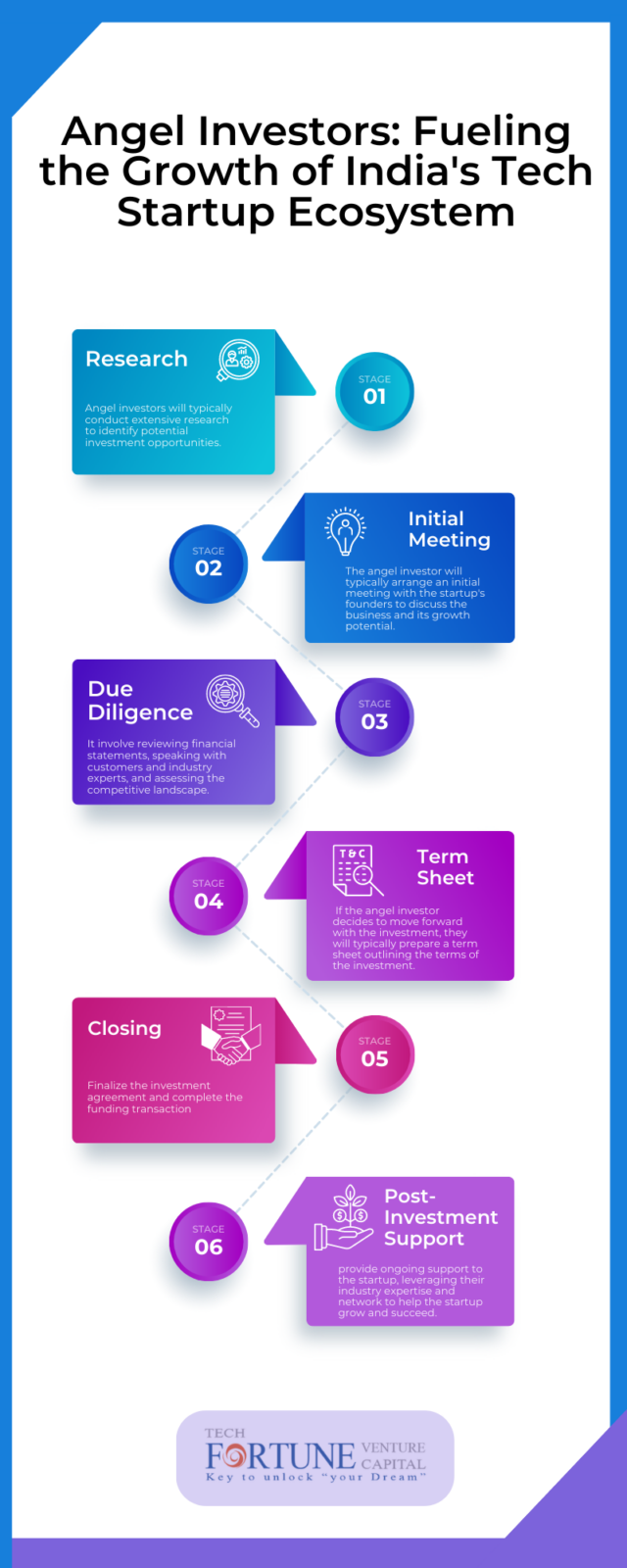

The process of angel investors helping to fund tech startups in India can vary depending on the specific investor and the startup they are considering investing in. However, the process may comprise the following steps:

- Research: Angel investors will typically conduct extensive research to identify potential investment opportunities. This could include attending networking events, reviewing business plans and pitch decks, and conducting due diligence on the startup’s financials and market potential.

- Initial Meeting: Once a potential investment opportunity has been identified, the angel investor will typically arrange an initial meeting with the startup’s founders to discuss the business and its growth potential.

- Due Diligence: If the angel investor is interested in moving forward with the investment, they will typically conduct more in-depth due diligence on the startup’s financials, business model, team, and market potential. This may involve reviewing financial statements, speaking with customers and industry experts, and assessing the competitive landscape.

- Term Sheet: If the angel investor decides to move forward with the investment, they will typically prepare a term sheet outlining the terms of the investment. Hence, this includes the amount of funding being provided, the equity stakes the investor will receive, and any other investment conditions.

- Closing: Once the term sheet has been agreed upon, the investor and startup will typically work with lawyers to finalize the investment agreement and complete the funding transaction.

- post-Investment Support: After the funding has been provided, the angel investor may provide ongoing support and guidance to the startup, leveraging their industry expertise and network to help the startup grow and succeed.

“Maximize your potential with Techfortune Venture Capital. Our angel investors are waiting to help fund your tech startup in India. Contact us and let’s make it happen.”

Perks of Angel Investors- “When it comes to investing, angel investors are heaven-sent.”

- Angel investors can provide a range of benefits to tech startups in India. Firstly, they can provide much-needed funding to help startups get off the ground. This funding can be used for various purposes, such as developing prototypes, hiring employees, or marketing the service.

- Angel investors often have a lot of experience and knowledge in the industry, which can be valuable to startups. They can provide guidance and mentorship to the founders, helping them navigate the challenges of starting a business and avoiding common pitfalls.

- Angel investors can provide valuable connections to startups. They often have a network of contacts in the industry, which can be useful for startups looking to partner with other companies or find new customers.

Why Us:

“From seed to success, Techfortune Venture Capital is with you every step of the way.”

Techfortune Venture Capital is committed to our mission of fostering a positive catalyst role for startups in the new normal and contributing to nation-building by establishing sustainable business models and a lasting startup ecosystem.

Unlock your business’s potential with our assistance.

Our team of experts can help you develop effective capital structures and growth strategies, providing you with innovative ideas to maximize your business’s potential.

What sets us apart?

Our deep understanding of venture funds and our ability to provide personalized mentorship can help you achieve the ideal growth strategy.

Techfortune Venture Capital’s comprehensive approach to angel investing includes not only financial backing but also personalized support, strategic guidance, and a deep understanding of the startup ecosystem.

Don’t let funding hold you back. Connect with angel investors in India and watch your tech startup take off.

Hence, Angel investors can play a crucial role in helping tech startups in India get off the ground. They provide funding, mentorship, and valuable connections to startups, which can help them succeed in a highly competitive market. With the right angel investor, a tech startup in India can achieve its full potential and disrupt the market with innovative products or services.

“Ready to take your tech startup in India to new heights?

Connect with Techfortune Venture Capital and our network of angel investors to secure the funding you need to turn your vision into reality. Don’t let funding be the barrier to your success.

Contact us today and let’s make your dreams a reality.”

FAQ:

Q1. How can tech startups in India attract angel investors?

A: Tech startups in India can attract angel investors by developing a strong business plan, demonstrating a clear market need for their product or service, and showcasing a talented team with the ability to execute their vision. They can also attend networking events and pitch competitions to meet potential investors and build relationships.

Q2. What criteria do angel investors look for when considering investing in a tech startup?

A: Angel investors typically look for startups with a strong and scalable business model, a solid team with relevant experience, a large and growing market, and a clear path to profitability. They may also consider the company’s intellectual property, competitive landscape, and the founder’s passion and commitment to the business.

Q3. How can tech startups in India find angel investors?

A: Tech startups in India can find angel investors through various channels, such as online angel investor networks, angel investor groups, startup accelerators and incubators, and personal networks. They can also attend startup events and pitch competitions to meet potential investors.

Q4. What common terms and conditions may angel investors require in their investment agreements?

A: Angel investors may require a minimum return on investment, a seat on the company’s board of directors, a right to participate in future funding rounds, and certain restrictions on the company’s operations and management. They may also require the founders to sign non-compete and non-disclosure agreements. Therefore, it is important for founders to carefully review and negotiate the terms of any investment agreement before signing.

Q5. Are there any government schemes or programs in India that support angel investing in tech startups?

A: Yes, several government schemes and programs in India support angel investing in tech startups, such as the Startup India Seed Fund Scheme, the National Initiative for Developing and Harnessing Innovations (NIDHI) Seed Support System, and the SIDBI Fund of Funds for Startups (FFS). These programs provide funding, mentorship, and networking opportunities to angel investors and startups alike.