From MRR to NPS, these are the metrics every startup should follow in their first year.

Startups always look for ways to measure their success and growth, especially in the first year of operations. Therefore, it is crucial to keep track of specific metrics that can help them identify where they are excelling and where they need to improve. This article will discuss the metrics a startup should follow up in its first year of operation. These metrics will help startups to make data-driven decisions, identify growth opportunities, and attract potential investors.

As a startup, keeping track of your performance and growth using specific metrics is essential. At Techfortune Venture Capital, we understand the importance of data-driven decision-making for startups. In addition, we specialize in providing capital and support to early-stage startups to help them achieve their growth goals. If you are a startup looking for funding and support, please get in touch with us today to learn more about our services.

As a startup, tracking the right metrics is decisive for measuring your success and identifying areas for improvement. Therefore, it’s important to focus on the metrics that matter most in your first year of operation to ensure your business is on track and you can make data-driven decisions.

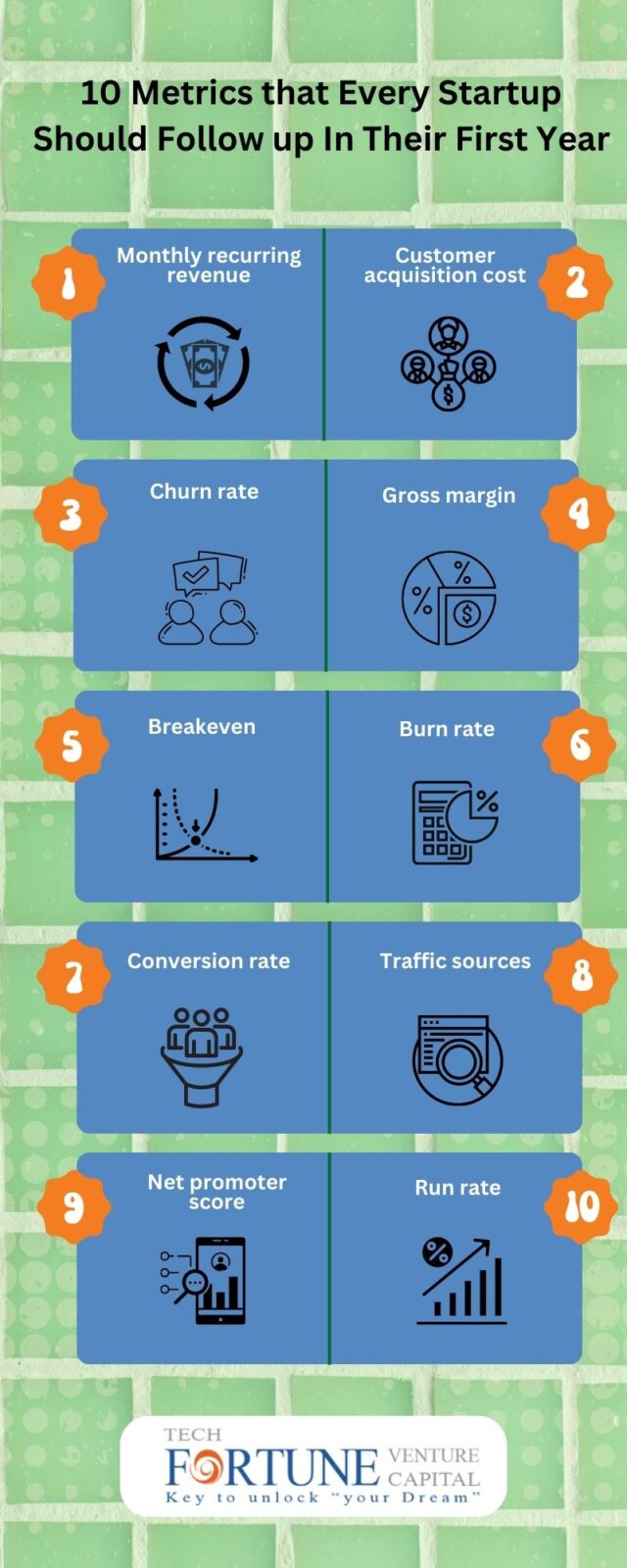

Here are 10 metrics that every startup should follow up in their first year:

Monthly recurring revenue (MRR)

MRR is the amount of predictable revenue that a company can expect monthly. Tracking MRR allows startups to understand their revenue growth over time and make informed decisions about resource allocation and expansion. As a startup, it’s important to increase your MRR consistently.

Customer acquisition cost (CAC)

CAC is the cost associated with acquiring a new customer. It’s important to track CAC to ensure your customer acquisition strategy is effective and sustainable. You want to keep your CAC as low as possible while still acquiring high-quality customers.

Churn rate

Churn rate is the percentage of customers who stop using your product or service over a certain period. Tracking churn rate allows startups to identify areas where they need to improve their product or service and reduce customer attrition. Conversely, a high churn rate can be a sign of customer dissatisfaction or a lack of product-market fit.

Gross margin

Gross margin is the difference between revenue and cost of goods sold (COGS). Tracking gross margin allows startups to understand their profitability and make informed pricing and product offerings decisions. Therefore, it’s important to maintain a healthy gross margin to ensure sustainable growth.

Breakeven

Achieving breakeven is significant for a startup because it signifies that the business has reached a point of sustainability. Prior to breakeven, the company may have been operating at a loss, where expenses exceeded revenue. Once breakeven is achieved, each additional unit sold or additional revenue generated contributes to profitability.

Breakeven analysis is a crucial aspect of financial planning for startups. It helps entrepreneurs to determine how much revenue they need to generate in order to cover their costs and avoid losses. Understanding the breakeven point assists in setting pricing strategies, assessing sales targets, and making informed decisions about resource allocation, cost control, and growth strategies.

Burn rate

Burn rate is the rate at which a company is spending its cash reserves. It’s important to track the burn rate to ensure that your spending is sustainable and that you have enough runway to achieve your business goals. Conversely, a high burn rate can indicate unsustainable growth or poor financial management.

Conversion rate

Conversion rate is the percentage of website visitors or leads who take a desired action, such as purchasing or signing up for a trial. Tracking conversion rates allows startups to understand the effectiveness of their marketing and sales strategies and make informed decisions about optimization and testing.

Traffic sources

Tracking traffic sources allows startups to understand where their website visitors are coming from and how they find their business. This information can be used to optimize marketing efforts and identify areas for improvement. Therefore, it’s important to focus on diversifying traffic sources to ensure sustainable growth.

Net promoter score (NPS)

NPS is a metric that measures customer satisfaction and loyalty. It asks customers how likely they are to recommend your product or service to others. Tracking NPS allows startups to understand customer sentiment and identify areas for improvement. A high NPS can be a sign of strong customer satisfaction and loyalty.

Run rate

Run rate is the projected annual revenue based on current performance. Tracking run rate allows startups to understand their growth potential and make informed decisions about resource allocation and expansion. Hence, it’s important to focus on increasing the run rate consistently to ensure sustainable growth.

How can Techfortune Venture Capital support?

Techfortune Venture Capital can support startups in tracking and improving crucial metrics in the first year of operation. We specialize in providing capital and support to startups, and our team of experienced investors and advisors can help startups identify the most important metrics for their businesses and provide guidance on how to improve them.

We can help startups to track monthly recurring revenue (MRR) and identify the factors that affect it. In addition, our team can provide guidance on pricing strategy, customer retention, and expansion strategies that can help to increase MRR.

Customer acquisition cost (CAC) is another important metric that we can help startups to optimize. We can also provide guidance on marketing and advertising strategies that can help reduce CAC and customer retention strategies that can help increase customer lifetime value (CLV).

We can also help startups to track churn rates and provide guidance on customer retention strategies that can help to reduce churn. In addition, our team can provide guidance on product and service improvements, customer support strategies, and pricing strategies that can help to improve customer satisfaction and loyalty.

Burn rate is another important metric that we can help startups to manage. We can provide guidance on cost optimization, fundraising, and revenue generation strategies that can help reduce burn rate and increase runway.

Finally, we can help startups to track and improve their net promoter score (NPS) and gross margin. Our team can provide guidance on customer satisfaction strategies, product and service improvements, and pricing strategies that can help to increase NPS and gross margin.

By helping startups to track and improve these metrics, we can help them to make data-driven decisions, identify growth opportunities, and attract potential investors. If you are a startup looking for metric support, don’t hesitate to contact us today to learn more about how we can help your business succeed.

In conclusion, startups should focus on tracking the metrics that matter most in their first year of operation. These metrics include monthly recurring revenue, customer acquisition cost, customer lifetime value, churn rate, gross margin, burn rate, conversion rate, traffic sources, net promoter score, and run rate. By focusing on these metrics, startups can make data-driven decisions and ensure sustainable growth.

Tracking these metrics can help startups make data-driven decisions, identify growth opportunities, and attract potential investors. In addition, these metrics can help startups to understand their performance, identify areas for improvement, and ensure that they are on track to achieve their growth goals. At Techfortune Venture Capital, we encourage startups to focus on these metrics and use them to guide their decision-making. If you are a startup/business owner looking for support, please contact us today to learn more about our services.

FAQ:

Q: What is the importance of monitoring Monthly Recurring Revenue (MRR) for startups?

A: Monthly Recurring Revenue (MRR) is a crucial metric for startups as it measures the predictable revenue the company expects to receive monthly. It is essential to track MRR to understand the recurring revenue stream and identify the factors that affect it. By monitoring MRR, startups can identify if they are acquiring new customers, retaining existing ones, or if there is a drop in demand for their products or services. Additionally, tracking MRR can help startups to forecast revenue, plan budgets, and make data-driven decisions.

Q: Why is Customer Acquisition Cost (CAC) an important metric for startups?

A: Customer Acquisition Cost (CAC) measures the company’s cost to acquire each new customer. Keeping CAC low, especially in the early stages of the company’s growth, is essential to ensure profitability. By monitoring CAC, startups can identify the most cost-effective channels for customer acquisition and optimize their marketing and sales strategies accordingly. Additionally, tracking CAC can help startups understand their customer’s lifetime value, identify areas for improvement in their sales and marketing processes, and make data-driven decisions.

Q: How can startups improve their Net Promoter Score (NPS)?

A: Net Promoter Score (NPS) measures the willingness of customers to recommend the company’s products or services to others. It is essential to keep NPS high, as it indicates customer satisfaction and loyalty. To improve NPS, startups should focus on providing excellent customer service, listening to customer feedback, and implementing changes to address their concerns. Additionally, startups can incentivize their customers to provide referrals, offer loyalty programs, and create a positive brand image through social media and other marketing channels.

Q: What is the significance of monitoring Gross Margin for startups?

A: Gross Margin measures the percentage of revenue that the company retains after deducting the cost of goods sold. It is essential to keep the gross margin high to ensure profitability. By monitoring gross margin, startups can identify areas where they can reduce their costs, negotiate better deals with suppliers, and improve their pricing strategies. Additionally, tracking gross margin can help startups to make data-driven decisions about their product mix, pricing strategy, and cost structure.

Q: Why is it important for startups to have a long runway?

A: Runway measures the amount of time the company has until it runs out of cash reserves. It is crucial to have a long runway to ensure that the company has enough time to achieve profitability or secure additional funding. Therefore, startups should monitor their runway and plan accordingly to stay supplied with cash. By having a long runway, startups can focus on building their business without the pressure of securing additional funding or generating immediate revenue. Additionally, a long runway can help startups to weather economic downturns or unexpected expenses.